What is private debt?

There are a variety of private debt subcategories which are also known as strategies, much like managed fund strategies, by examples of: top-down investing, bottom-up investing, fundamental analysis, technical analysis, contrarian investing, dividend investing.

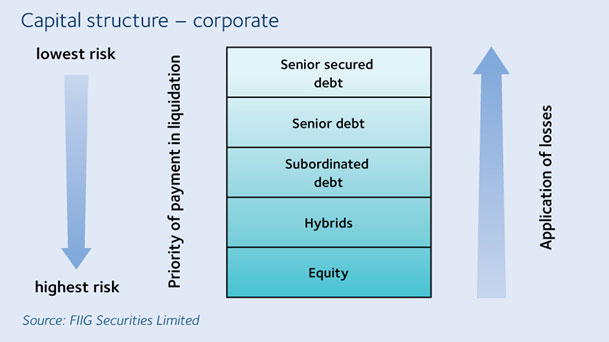

A little different to equities, private debt can be segmented into several different strategies alongside capital structure, which is a mix of debt and equity that a company uses to finance its operations and growth. The caveat of capital structure is that depending on the balance of debt to equity, it influences how easily the company can obtain funding (debt), to how expensive funding will be, which is a determinant of what the return will be for both the lenders and investors.

Capital structure is what separates private debt from equities, with senior secured debt being a class of loans with priority repayments should a company go into bankruptcy. Equities, also known as ‘common equity’, is the most junior of the capital structure representing a stake in the company, with payments made after all other obligations are paid off. As equities have the highest risk in the capital structure, so are the returns, uncertain in nature.

Private Debt strategies

There are a variety of private debt subcategories which are also known as strategies, much like managed fund strategies, by examples of: top-down investing, bottom-up investing, fundamental analysis, technical analysis, contrarian investing, dividend investing.

A little different to equities, private debt can be segmented into several different strategies alongside capital structure, which is a mix of debt and equity that a company uses to finance its operations and growth. The caveat of capital structure is that depending on the balance of debt to equity, it influences how easily the company can obtain funding (debt), to how expensive funding will be, which is a determinant of what the return will be for both the lenders and investors.

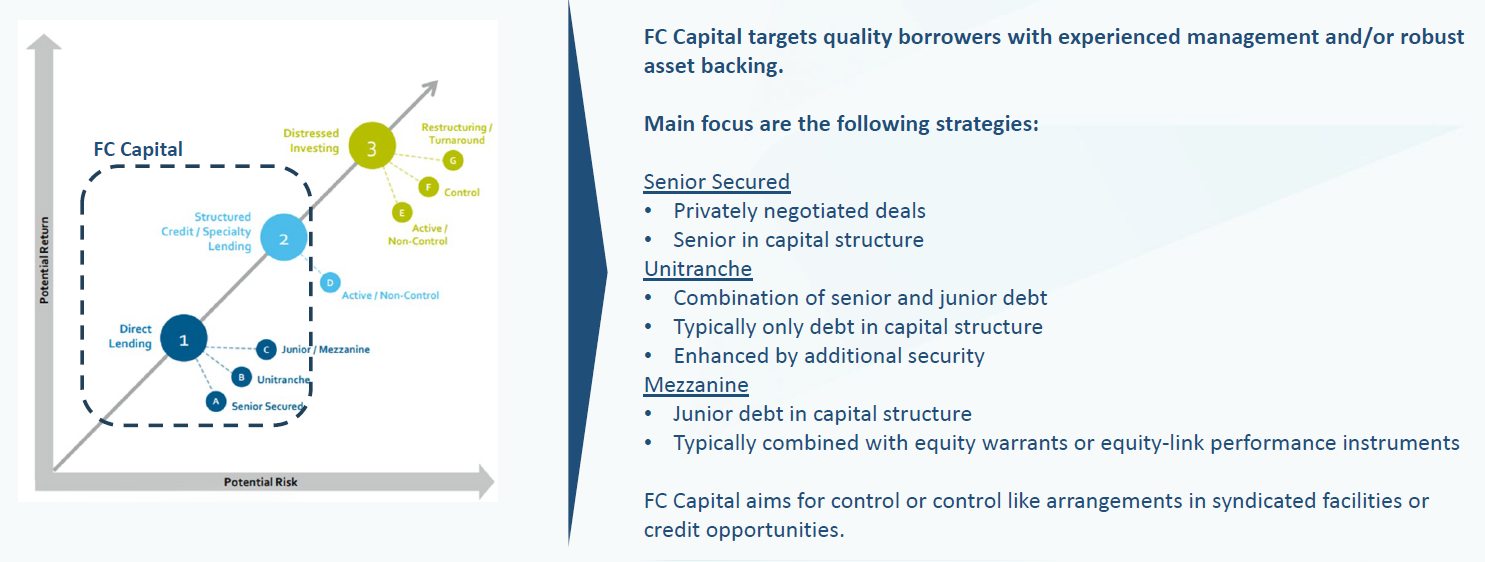

Mezzanine:

Investments in debt subordinate to the primary debt issuance and senior to equity positions.

Mid-Market Lending:

A form of direct lending typically to smaller and more-leveraged companies than traditional direct lending.

Senior Subordinated Debt:

Debt that is subordinated in its rights to receive its principal and interest payments from the borrower to the rights of the holders of senior debt. Such loans are sometimes secured by significant collateral; the firm will principally rely on the borrower’s cash flow for repayment. Additionally, the manager often receives warrants to acquire shares of stock in connection with these loans.

Special Situations:

Classification covering several areas including distressed and mezzanine, where loan decision or grade is defined by something other than underlying company fundamentals.

Subordinated Junior Secured Term Loan:

Subordinated debt has a lower priority than senior debt holders in a company’s capital structure but is secured against some assets or collateral of the company.

Unitranche Debt:

A type of debt combining senior and subordinated debt into one instrument. This instrument was created to simplify debt structure.

Glossary Source, Preqin

In summary, a private debt fund specialises in lending activities, where funds are raised from investors and lends that money to companies. It represents an alternative to bank lending as well as providing investors with exposure to the more bond-like returns and capital protection occurring from private debt as an asset class.

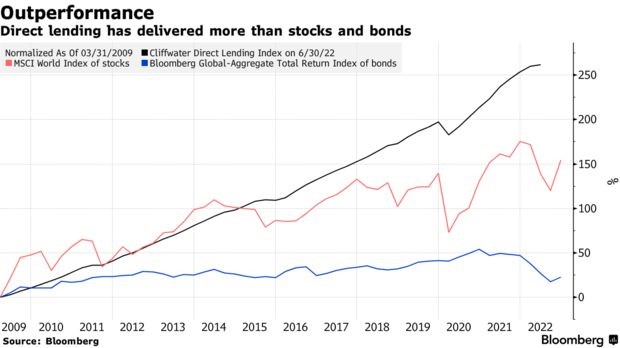

Compared to fixed interest, private debt presents equity like returns, coupled with downside protection.

DISCLAIMER

This website provides general information only. It does not take into account the investment objectives, financial situation or particular needs of any person and should not be used as the basis for making investment, financial, taxation or other decisions, and you should consider its appropriateness with regard to these factors before acting on it. The issuers of the products within this website can be found in the relevant disclosure document. Read the disclosure documents for your selected product before deciding. Any taxation information described is a general statement and should only be used as a guide. Before making an investment decision, you should seek independent financial or taxation advice and consider whether an investment is appropriate in light of your particular investment needs, objectives and financial circumstances.

Speak To Our Team

Get in touch with our expert team today. Fill out a small form to help us better understand your requirements.

Contact Us